Trusts Attorney Las Vegas | What Is The Best Practice For A Lawfirm?

Welcome to the trusted podcast. I am your host Blake Johnson today. We’re going to be talking about, uh, trust and estate planning, uh, which is right in my wheelhouse, but we are going to be talking about what a third party trustee is and when it makes sense to do that. So for that, I brought in, um, George from Charles Schwab. So George, thanks for joining us today and enjoy our Trusts Attorney Las Vegas services.

Yeah, thanks for having me Blake. We appreciate it.

Awesome. Why don’t you give me a little bit of background about yourself, um, personally, and then also about Schwab’s trust company and what makes you guys experts in the field of trust management?

Well, uh, I’ve been at Trump, uh, since 1997, uh, and I started in the downtown Minneapolis office. Uh, I’m originally from Minnesota, um, and grew up in a family where we were managing family trusts and Schwab knew that about my background and Schwab had acquired us trust in the late 1990s. Uh, and during that time, the idea was to expand westward and I had the opportunity to go back to law school and returned to Schwab U S trust, uh, as a trust officer . Um, so I earned my J D and masters in taxation at the University of Miami. Um, but during that time with us about our Trusts Attorney Las Vegas, Schwab had sold us trust to bank of America. Uh, so after graduating and finishing the bar exam, uh, I would temporarily work for bank of America and ultimately found my way back to Schwab where we’ve started a trust company from scratch here in Las Vegas, Nevada.

Um, I think for listeners, what they would might appreciate regarding Schwab is that we approach trust, um, in a way that’s very different in trying to meet or match the client’s needs or desires for how the trust is is administered. Um, with, I guess, kind of our ability to be very flexible, both with respect to investments and expenses. And so we’ll probably talk about it a little bit today, but, um, we actually have three different ways that we can help clients in this space, whether they be very self directed to meeting a full on corporate trustee.

Awesome. Um, so yeah, let’s start very basic. What is a third party trustee? And in general terms, you know, how can they help, uh, someone, you know, whether it’s being acting as current trustee or a successor trustee?

So the idea behind a third party trustee third party, meaning third party to the grand tour and his or her family, uh, is it’s typically a corporate trustee. So a bank or brokerage firm, um, a private fiduciary is typically who would be designated as a third trustee. And the idea is to bring in someone who’s objective. So with respect to beneficiaries, um, who may be dealing with other family members, uh, in making requests for distributions and that sort from a crust that can be difficult and who can put family members in a difficult position. So sometimes by listing a corporate trustee or a third party trustee into the mix, it creates some objectivity that just strictly the rules of the trust are being followed. There’s no judgment being made with respect to the person making the request. It’s just following the rules that the grand tour has put in place.

Um, I think some of the other advantages of a corporate trustee or a third party trustee is typically they’re in the business of recordkeeping and preparing taxes for the trust, which might be something new or foreign, uh, to a first-line party trustee, such as a family member who may not be in that business or regularly conducting those kinds of returns. Um, so there are some advantages there in terms of, uh, uh, I think precision accuracy and timeliness. Um, so I don’t know if you want me to drill down further on that, but I think that’s a simple answer with us and have a good Trusts Attorney Las Vegas solution.

Okay. Yeah. And maybe talk about, um, maybe more security as far as, you know, less, less risk of fraud or embezzlement from, you know, a trustee’s perspective as well. What, what kind of security measures typically a corporate trustee has in place for that?

I think there are a couple of things to consider as you, um, unpeel the onion on unsecurity. Uh, the first one that I think of is when you have a first line family member as a trustee, you know, they’re having to navigate multiple stakeholders of the trust and you have your first blind beneficiaries and it might be receiving income. And then you also have your remainder beneficiaries who will receive the assets after the, um, initial beneficiary, um, and successfully navigating the interest of those stakeholders can be difficult. For example, if you have a beneficiary, maybe a son or daughter, uh, who’s inherited the particular assets, and they’re also serving as a trustee, the pose, a conflict of interest to the remainder beneficiaries who may be seeking longterm growth in the trust. So there’s something left over after that first line. Beneficiary is no longer in the picture and that’s one element of security. I think the other element that Blake may be referring to is using a custodian such as Schwab or, or a firm like Schwab, um, that has internal and external auditors monitoring their procedures as a trustee. Number one, um, safeguarding the assets is, you know, front and center for those organizations and making sure that the assets are both preserved, um, and not subject to whether it be creditors or other third parties who may become, come knocking on the door.

So think, um, it speaking to those procedures that you have, you know, if it’s an individual family member, you know, they don’t have anybody checking in to make sure they’re actually doing things the right way other than, you know, this, the accounting that they’re supposed to be doing on a regular basis. Whereas if you have a third party corporate trustee, you know, it’s a minimum of two or three people who are looking at, um, the accounts, making the decisions on when to make distributions and so on. So there’s not really a chance for anybody to take that money, the situation that comes to mind and why I want to bring this up is, um, you know, here in Las Vegas, we had an attorney named Rob Graham who named himself. I mean, the client signed off on it. Um, but as successor trustee for a lot of clients and, uh, when they passed away, he was the one administering it.

Well, he got tempted and he ended up taking some of that money for whatever reason he needed it for. Was it whether it was to make payroll or, you know, whatever expense with the idea of paying it back, but he just never did. And so that’s how he got himself in trouble, ended up being, you know, $10 million that he had taken from these different trustee or trust company, or I’m sorry, different family trusts. And, um, you know, so it was a really sad situation. So that’s where I think having a full corporate trustee, as opposed to just an individual, even if it is an attorney, um, makes a big difference in that regard with us and get a better level of Trusts Attorney Las Vegas today.

And I think that’s right, Blake it’s, who’s watching the watchdog. And so when we administer a trust, a family member has really kind of put that honor and responsibility on our organization. You know, whether it be the state of Nevada and their regulators, as well as our corporate internal regulators are watching every single thing we do. And we are answerable to our conduct and our actions.

So let’s take a step back lets you probably come into situations where you get asked to be trustee after, you know, individuals, um, tried to handle it themselves. What are the biggest mistakes you see individual or family member trustees make?

Well, one of the biggest is actually before the trust ever comes into existence. And one of the things that, um, an attorney like Blake does for clients is he creates an estate planning package. Um, and trust is just one element of that particular package. Um, so when a particular family member dies, um, one of the challenges and mistakes that we see is it failed to immediately go back to the drafting attorney, um, indicate that the person is deceased, um, and really getting a sense of the responsibilities, the timeline, um, that needs to take place in order to take advantage of opportunities that exist in the wake of that person’s passing. Um, those opportunities really relate to the tax returns of the individual, the sheet, and the trust that’s being created and the estate that will arise out of that. Decedent’s passing and there’s a real artwork to the design of those returns and the considerations that go into them with our great Trusts Attorney Las Vegas, where we step in and notice the mistake is the failure to elect certain exemptions with respect to these trusts or being unsure about them, which then can lead to the trustee, making distributions to family members that may involve exempt dollars from the estate that, um, you know, should have not perhaps been spent first, but perhaps later, uh, in light of non-exempt dollars, which I don’t know, Blake, if you want to get into that today, but that is one of the common mistakes that we see right from the very get, go.

I don’t know that I want to go too deep into that, but just for our listeners, you know, exempt, meaning federal exemption from estate taxes. And, um, you know, those considerations is, is what we’re talking about. And that’s one of the reasons why we bring on experts like this is because, you know, that does get complicated. And so you want, if you are in that situation, you want to be talking and discussing that in more detail. Um, let’s talk about, go ahead.

I was just going to say one other thing. I think, you know, more practically beyond just, you know, kind of, uh, uh, getting everything up and running the, the mistakes that we typically see when we’re taking on the trusteeship from a family member really have to do with the, the record keeping in particular, um, the production of statements accountings. Um, we recently saw a trust from Cheyenne Wyoming, um, where a family member had been in administering it for the last eight years and did not realize that they needed to be filing trust tax returns. Um, that failure to recognize that issue when it came into our shop, um, you know, was immediately identified by the trust officer who promptly then set the course to file those returns that had not been completed. Um, unfortunately for the trust that resulted in $364,000 in both penalties and interest for payment not having been made, which again, just using a corporate trustee, a third party trustee, or even simply going back to someone like Blake and saying, Hey, what do I need to do here? Um, you know, could certainly have mitigated that, that issue or problem, but very commonly as it relates to the record keeping and the, uh, of, uh, fulfilling all the obligations as a trustee.

Well, that leads perfectly into my next question, which was why does it a trust company makes sense? You know, even for the average person, let’s say they don’t have an estate tax issue, uh, but they’re, you know, it’s somebody who’s going to have a million million five when they pass away. Um, you know, does it make sense for a trust company to step in and be that successor trustee for us and have ? And I think right there, you pointed out one very important reason of why it should be. You have, you know, it takes that burden off the individual, um, of making sure all the records and everything are done properly. Is there any, anything else, major reasons why it would make sense for them to, to have a third party trustee as such as swab versus just the naming a family member?

Well, I think also, but there’s a perception that by using a corporate trustee, it can be more expensive than maybe a first time family member taking it upon themselves to do the work. And I think in some cases to be fair, you know, it can be less expensive to use a family member. Um, I don’t disagree with that. However, um, peeling apart, the onion, one thing to recognize is that a family member, if they don’t have the expertise to do the investment portfolio management, they’re likely going to outsource that for a C if they’re not experienced in tax preparation, they’re going to have to outsource that to an accountant for a fee. And in many cases, the family member is also entitled to compensation as the trustee under the statutory commission rates. And when you factor all of that together frequently, they’re paying double the triple what a corporate trustee would have charged. So I do think, um, when, when looking at the expenses of a trustee it’s worth, again, really looking through those numbers and assessing what is the best option, especially if the family member isn’t that keen on doing it themselves.

Yeah, I totally agree. And then the other thing to consider is, um, where I see a lot of the fights is, you know, uh, clients will always like the default. I’m going to say the name, the oldest child, even if that does not make the most sense, cause they’re not great with finances or, you know, they don’t get along with the rest of the siblings or whatever. It’s just like, Oh, well they’re the oldest when you enjoy our Trusts Attorney Las Vegas. So that’s kind of their right. We’re going to name them as the trustee and they just name one child. And, um, whether the child does anything wrong or not, the other kids have that perspective of, Oh, well you took that asset and put it in your trust because you thought it was going to be worth more or perform better over the long haul or whatever the case is. So they always kind of have that almost blame or anger towards that one sibling who’s the trustee, uh, because they’re a global, you had, you were the one who got to choose it.

Wasn’t fair. Whereas if you have that taken out of their hands and it’s, you know, somebody else who’s looking at it objectively, you eliminate those concerns, or if they, even, if they have a concern, it’s, you know, it’s not a fight within the family it’s against, you know, a company. And so it, it helps keep the family more unified has been my experience with that. And so that’s, that’s another reason why I think even on a small scale, it’s totally worth it to get a trust company involved. Um, just to, to shift that blame away from the individual.

I think oftentimes being chosen as the family member trustees initially considered to be an honor, but once the person gets into it, um, it sometimes becomes a thankless job where sometimes the person didn’t even want to do it. Uh, and now they’re being blamed for having done it and, um, know they never invited it into their life in the first place. So again, just something that, um, open, transparent communication of where possible between the trust maker, um, and his or her beneficiaries can go a long way towards, you know, eliminating those potential jealousies downstream and using a third party, trustee can really help, um, uh, as an option alleviate some of those, uh, uh, potential concerns.

Yeah. The other thing I see as even though the family member may be entitled to take trustee fees, cause they’re doing a lot of work and if you haven’t been in that position, you don’t know how much work has involved. Um, but the family members think, well, you’re a family member. You’re getting part of the trust. So you should, you should just not, you should waive that fee and just get, um, you know, what you’re entitled to. And it’s like, no, they, they put in a lot of work. They actually should take that percentage off the top. But you know, there’s that, once again, that persp perspective of, well you’re already getting money, so it doesn’t matter. And so if they do take the fee, it causes more fights. So once again, it just, it shifts everything off the family member. That’s doing that to the trust company and it just makes it so the family can be happy and can actually grieve properly from mom and dad passing instead of worrying and fighting about the money. Alright. So let’s talk about, um, choosing a trust company. So, you know, you’ve worked for two different trust companies. What, what are the main things that an individual should look at, um, and, or, and consider when they’re looking to pick a trust company to be their successor trustee or even their current trustee?

I think there probably three or four primary considerations, this is not an exclusive list, but I think the ones that, um, come most to mind, um, first and foremost are fees and let’s be practical. Um, what exactly are you going to be paying for, um, expenses matter on these trusts, because if you’re trying to leave a longterm legacy and there’s constantly, you know, uh, uh, chipping away at the capital base for expenses that, um, you know, could be contained, um, more conservatively, why wouldn’t you at least look at that issue? Um, we’ll circle back to that in a minute, but again, fees and expenses matter second, um, portfolio flexibility. Um, what are the options, um, you know, within the, um, corporate trustees, um, framework to, to choose different investments, whether that be your more traditional stocks, bonds, cash, and real estate, the things that, um, you know, might be more on the edges of an investment portfolio, such as hedge funds, private equity, um, perhaps the family has a farm ranch land, Timberland, mineral oil, gas, interest, those sorts of things.

Again, what is the trustee’s ability to take on successfully manage those assets that matters? Uh, the third item would be the relationship. Um, the relationship with your principal players, uh, at the trust company, those would principally be the trust portfolio manager, the trust officer and the relationship manager who is often, uh, helping beneficiaries with the financial planning behind their distributions and how the trust ultimately is being run. Um, but again, relationship matters. And I think the fourth thing that’s not talked about enough is where is your trustee located with our Trusts Attorney Las Vegas? Um, these days. And I think over the last 20 years, Blake, there’s been, um, a gravitational pull towards trustees and locations like Nevada, Delaware, South Dakota, Alaska, just to name a few and the location of your trustee when you’re coming from a state like New York, Oregon, Hawaii, California can definitely matter with respect to state income tax. Um, so review me that with your attorney and having someone like Blake who understands those issues and having a holistic discussion with you from the outset can really make a big difference, uh, in terms of the long run functioning of your trust.

Yeah. Uh, the, the location I agree is not talked about enough because yeah, you have the state income tax issues. You also have the flexibility of what the trustee can do in different States. And then you have the asset protection standards, um, you know, are the trust assets actually protected through your state law, um, versus, you know, coming to a state like Nevada, where we have very protective statutes in place for trusts. Um, so yeah, I’m glad you brought that up. Let’s go back, let’s go back to fees. Cause I think that’s, you know, obviously the, the number one concern for people what’s, um, this is one of the things that I really like about Schwab, cause it’s very rare in the trust management, uh, community. How do you guys treat real estate, um, as opposed to, you know, like, uh, any other trust company that somebody might encounter?

Well, again, I don’t want this necessarily to sound like a, Schwab commercials, so I want to be fair to the audience, but for any of you that may be considering a corporate trustee. I think the thing to focus on with respect to real estate is how has the trustee charging for their administration of the real estate. And many of you will find that institution or charge a percentage against the market value of the property. Um, our thought at Schwab is that that’s an affair, um, because it’s really not representative of the work required to administer the property for great solutions according to our top Trusts Attorney Las Vegas. So our approach is to charge a flat rate. Um, we charge a $3,000 a year flat rate fee to administer a real estate property. Um, and the reason for that is the primary duties have to do with the upkeep and maintenance of the particular asset, the property taxes, and not just paying the property taxes, but looking at the comparables, um, of the particular, uh, property assessor and determining whether or not those are reasonable and evaluating when it’s right to petition for reassessment. And that’s a core component. And then of course, looking at the insurance and making sure that the insurance provider is charging a reasonable rate for the actual value of the property. Um, so again, our approach is a flat rate process. And again, something to take a look at, if that’s an asset in your trust.

Yeah, I think that’s, especially if you get into property, that’s worth millions of dollars, it’s a vacation home or whatever that can make a huge difference in cost savings. And the reality is with, with investments, there’s, there are management fees, cause you’re looking at, you’re constantly looking at where things are invested in how to, you know, make sure that portfolio is performing, but it’s not the same with real estate as you brought up it’s yes, there’s work involved for sure. But it’s not to the same extent, um, on a daily basis, I think, compared to the actual investment portfolio, am I right in that?

Yeah, that’s right. You know, the proportion and value of the property doesn’t make the job any different. So, um, especially for those of you that, you know, have enjoyed a substantial capital gain in real estate, which has really been the case. Um, when you look at coastal California in particular and just the nation as a whole, um, people have done well in that asset class. And, um, you know, it, trustees shouldn’t be penalizing you, uh, in terms of fees because you’ve enjoyed that growth. It’s a job, it’s a controllable job. But I think that the expenses associated with doing the work are pretty identifiable.

All right. So my next question is what are the red flags people should stay away from when they’re looking at a trust management company? What’s kind of thing that should be like, Ooh, I don’t know if you want to go with them.

Well, I think part of it is the layering of fees. So we talked about one item where, you know, you’re, you’re being perhaps assessed a percentage of the market value of the underlying property, but when you get to the marketable securities, um, ensuring that you’re not paying fee on fee. So in many cases you might be paying a trustee fee. And then in addition to that, paying more with the investments being selected, uh, in this day and age, you know, mutual funds, uh, what our, in our industry called wrap accounts or separately managed accounts, present additional fees to those portfolio managers that can really tax a trust unnecessarily for something that can be done in a much more efficient manner. Um, so again, looking at kind of those expenses, um, I think another item that we commonly see is mistakes or, um, being late on the filing of tax returns for the trust.

And that does seem to be a common issue. Uh, one of the things that we strive for is giving all stakeholders have a trust, complete transparency. So at any time, uh, on their own schedule, they can use their mobile app or our website to get exactly up to the second updates on what’s going on with their trust, whether it be the investment performance or distributions that are, that have been going out of the trust, they know exactly where they stand. Um, third item Blake would have to do with the timing of making a request of your trustee for distribution and it taking in an inordinate amount of time to get approval or rejection of for that particular request. Um, frequently beneficiaries are trying to make decisions, um, and perhaps using the trust as a resource to fund a particular, whether it be opening a business, whether it be buying a new house, uh, maybe replacing the roof on a house, um, you know, all of those are decisions. Jillian involves a third party. Who’s waiting to deliver a quote and being timely in the delivery of that decision can help a beneficiary, negotiate the pricing for different projects and things in their life. And I think again, that timeliness and accuracy definitely matters. So if you’re struggling with those issues with the trustee and not getting what you need, it might be worth taking another look. Um, and of course, you know, we would love to be part of that discussion.

Are there any websites or, uh, um, governing bodies that would rate, uh, trust companies, maybe they’re, you know, how solvent they are and that kind of stuff, or is it just kind of, um, you know, whatever they happen to have their reviews online?

Well, unfortunately at this point in time, there isn’t really an industry magazine or something like that that produces this information easily. And I’m sad to report that. Um, I w I get asked the question a lot and there just doesn’t seem to have been developed something to do that, but maybe I can offer a few things that are useful, um, trust in the States and magazine, isn’t really a widely published, uh, you know, um, tool, but a lot of attorneys subscribed to it. Uh, I have seen with us and our great Trusts Attorney Las Vegas, uh, periodically ratings of trust companies, or at least an attempt to do that. What happens unfortunately is that either regional base or it’s a very small subset of trust companies that are being evaluated. So just there are limits to using that as a tool. Um, you might be able to look at organizations, um, whether it be, um, the national association of estate planning council, it’s also called an Epic, um, I don’t know their website off the top of my head, but if you Google me pic again, and as in Nancy eight E P C, um, they should have some resources that might guide folks.

Um, whether it be the considerations or actual trust companies, um, that might be worth taking a look at. And I think also talking to your attorney, your attorney is in the best position, having worked with many different clients, um, and trust company and choices to have a good sense of the who’s, who, um, so I think in this day and age, really going to the attorney and talking to them about their experience, um, you know, the pros and cons and the priorities that you have, uh, certainly, um, uh, the GoTo plays for that kind of information. Yeah.

And typically if you’re in that situation where you need to trust a corporate trustee, you have friends that have, have been in that situation and have worked with them, or, you know, have chosen somebody. Um, so you can ask them. That’s always one of the things with, with anybody we bring on the show is, you know, ask around, ask your attorney, ask your contact, see who they’re using. You know, that’s a great way to find ones. Um, I also want to add that, um, you know, check the the company history, whether it’s online, you know, how long they’ve been in business for our great Trusts Attorney Las Vegas solutions. Um, and then, you know, if they’re a financial institution, there’s going to have some sort of rating, um, you know, if they’re, if they’re doing any sort of, uh, financial work on, um, you know, FINRA to make sure that they’re not in trouble with them, uh, and then you call so try and see if you can find them on, you know, Moody’s or, uh, any of the other rating companies for their, you know, how financially solvent they are to make sure they’re not going to go under. Um, but I mean, hopefully, you know, anyone you’re talking to is in that situation.

All right. Um,

Well let’s, how can people get in contact with you, George?

Yeah. So a couple of different ways, and you can certainly send me an email. It’s George G E O R G E dot Penong P as in Paul, E N N O C K George dot pennock@schwab.com or feels free to call me directly at (702) 820-3656. The other thing I want to mention Blake is my role is what’s called a trust services consultant. Um, and we take the consulting part of that, uh, very seriously. So what my role is is to really talk you through the different options, whether that be choosing a family member, happy to walk through that, and the different options, um, that are available at Schwab to help and support a family member choosing to do that. Uh, we can also, um, again, use different. We have three different trust options at Schwamm and it all relates or revolves around how sophisticated you want the investment portfolio to look. Um, and again, my role is to just show you how the tools work and put you in a position, uh, with Blake and near accountant to make a really good decision. So that’s how I help people

Are full and I’ll make sure I put, um, you know, the show notes, uh, in the show notes, your, um, your email on your phone number there so that the listeners can find you, uh, George, I appreciate you being on the show today. I feel like we’ve covered a lot of really good stuff. Um, is there anything else we missed that you think is just super important that we need to talk about before we end?

Uh, just one thing, um, when you are working with Blaker an attorney helping you in that space, you know, recognize that once you’re done drafting the documents, the work isn’t done, um, there are maintenance and upkeep with respect to the documents you’ve drafted. And really there are three principal things to watch for. If the family members, um, wind up changing either you’ve got a newborn or someone who’s passed away, Blake needs to know that also if you wind up having a significant change in your assets where you either sold a significant asset or acquired a new one, make sure Blake is aware, so it can help you with the planning of our Trusts Attorney Las Vegas solutions. And I think the third thing in the Eve of this coming up in November, the rules relating to trust and the exemption amounts are probably going to change and staying in tune with Blake’s that your plan always reflects the most up to date information, and rules is really important, but I’m super grateful for being on the call today, Blake, and again, really appreciative. Thank you.

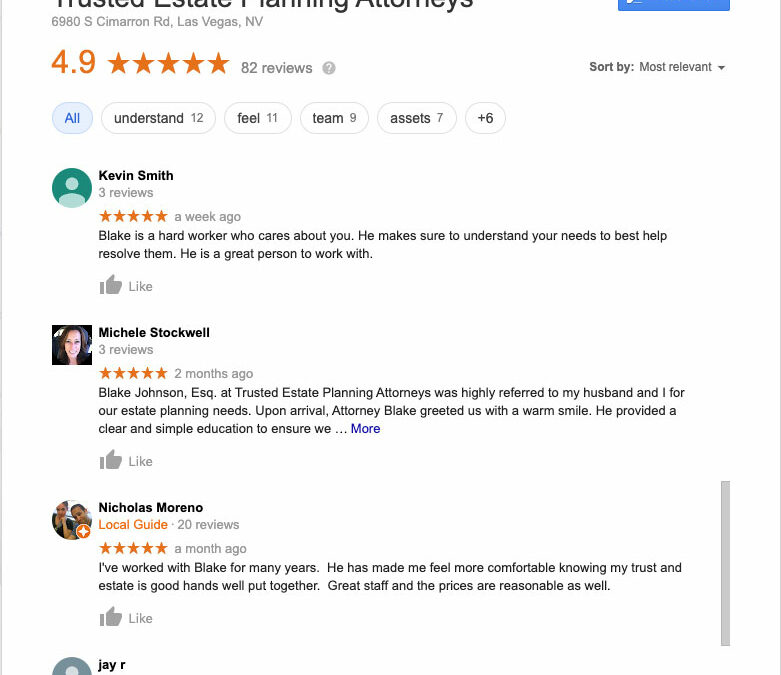

You’re welcome. You guys, you did us a favor. We appreciate you to our listeners as always, please like, and subscribe. So you get the latest content from the trusted podcast and also leave us a review, let us know how we’re doing, and then if you have any ideas on who we should have on next, please reach out. I’d love to see you. Um, your, what you guys want to know, we want to make sure we get the experts on here that you want to hear from. So with that, uh, we’ll sign it off for now and we’ll catch you guys next time.